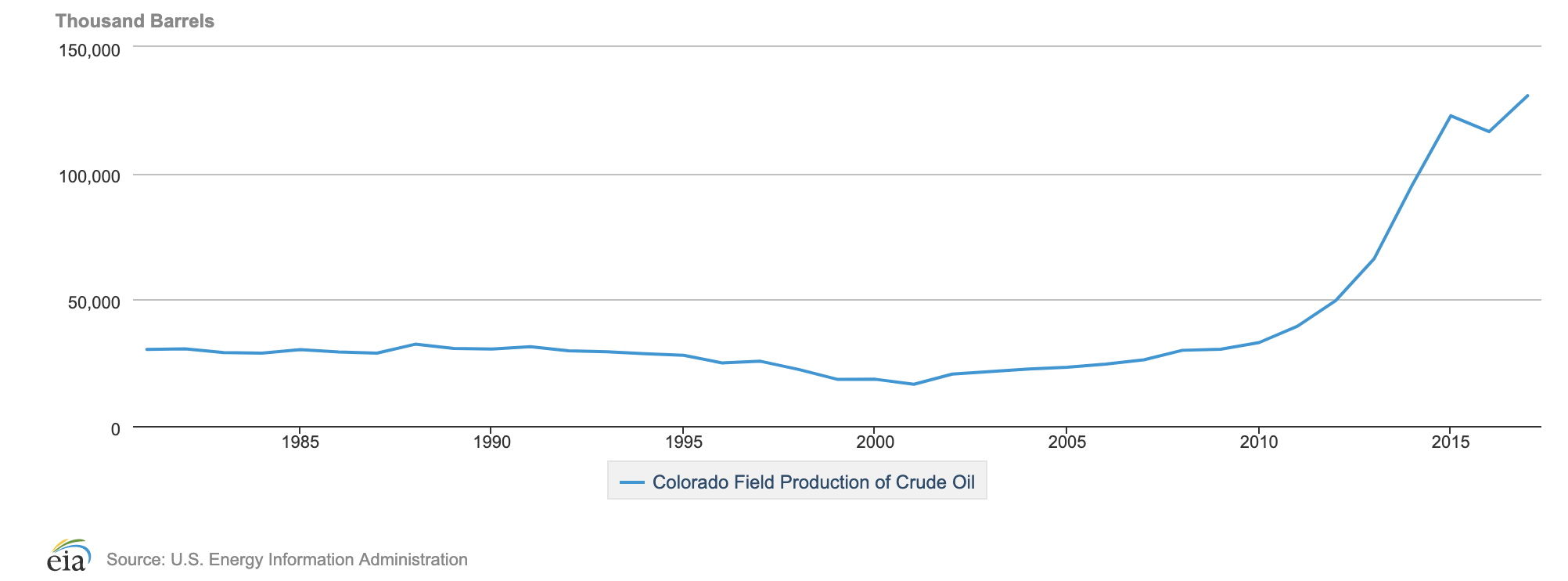

Colorado has a long history of oil and gas production, which means it has a long mineral rights history as well, since mineral rights are what entitle land owners to the oil and other resources in the ground. According to the Colorado state website, “Colorado oil production dates back to 1860, when the first oil well in the western United States was drilled in Florence, Colorado.” Today, Colorado is one of the largest oil producing states in the United States, ranking 6th in output with 130MM barrels of oil produced in 2017. Oil and gas production have grown significantly in Colorado in recent years and the industry has become a significant source of state revenue and employment, contributing approximately $1Bn in taxes and 89,000 jobs to the local economy. The chart below from the EIA shows Colorado’s annual oil productions since 1980.

According to the U.S. Energy Information Administration:

+ Colorado’s crude oil production has quadrupled since 2010, and the state holds about 4% of total U.S. crude oil reserves.

+ Colorado is the fifth-largest natural gas-producing state, and 11 of the nation’s 100 biggest natural gas fields are located in the state.

+ Electricity from renewable sources has more than doubled since 2010 to almost 25% of Colorado’s net generation in 2017, led by increased wind power from the state’s nearly 2,000 turbines.

According to a report issued by the Colorado Oil and Gas Association, “as of 2017, the upstream and midstream subsectors alone were responsible for providing 89,000 direct and indirect jobs, $13.5 billion of the state’s gross domestic product, and $1 billion of public revenue that supports Colorado schools, social assistance programs, parks and water infrastructure.“

The report goes on to say:

“Oil and gas is responsible for at least seven distinct streams of public revenue… And unlike other industries, the assessment rate on oil and gas lands value is 75 to 87.5 percent, as compared to 29 percent for the general assessment rate for corporate property. And unlike other industries, oil and natural gas extraction establishments pay royalties and taxes on the value production, in addition to taxes paid on earnings. The state receives royalties for oil and gas production from state and federal lands and severance taxes on all production in Colorado”

Clearly, oil and gas has grown to be an important part of Colorado’s history and economy. Because of this, Colorado mineral rights owners may have a valuable asset. Mineral right valuation depends on several factors, but knowing there is oil in the ground that is actively being extracted is a critical component. The best way to determine what your minerals are worth is to reach out to a mineral rights acquisition company like TPG Energy.