In February 2020, oil prices entered into a bear market again. A bear market is defined as a 20% decrease from recent highs (the inverse, a bull market, is marked by a 20% increase). West Texas Intermediate (“WTI”) crude, which is the most common benchmark for U.S. oil prices achieved a high of $65.65 on January 8, 2020. As of this writing in mid-February, WTI is floating right around $50 per barrel, a nearly 24% decline in a little over one month.

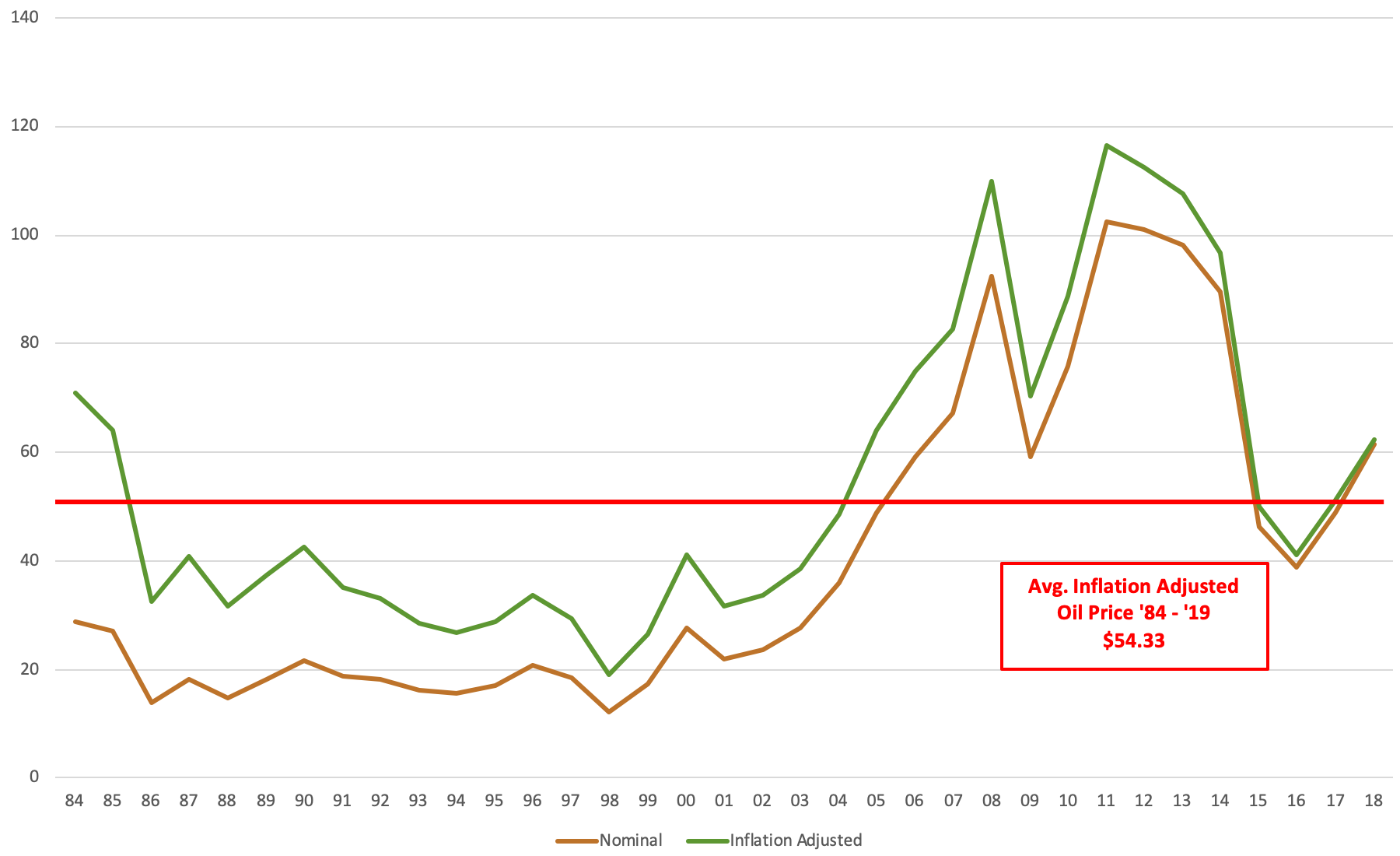

Oil has long been the most volatile commodity on the planet. So much of our daily lives and industry is powered by the energy oil provides that every news event is magnified and interpreted in attempt to estimate its impact on potential oil supply and demand. This makes predicting future oil prices an impossible task since we cannot anticipate future news. Because prices bounce around so much, as this article discusses it often makes sense to simply look the historical price of oil as an indication of its future prices. The logic of this approach is that we now have technology available that allows supply to be adjusted very quickly to meet demand, and vice-versa, so any price movement should be viewed as temporary, with a reversion back to the long-term average price to be expected over time.

In recent months, several news events have caused massive swings in oil prices: the September 2019 attack on the Saudi Aramco oil facility and the recent spread of the coronavirus are perfect examples of news that can cause prices to rise and fall as their impact on future supply and demand are estimated by traders in the market. The initial price movements after news breaks will almost always prove to be an overreaction, with prices reverting back to something closer to the long-term averages.

People who own oil and gas assets, such as mineral rights, need to have a reasonable estimate for long-term future oil prices in order to make informed decisions. Per the article referenced above, the historical real price of oil is approximately $54.00 per barrel, which is roughly in-line with prices as of this writing in early 2020. That is until the next “black swan” news event…